It’s a SpaceX World (Everyone Else is Playing Catch-up)

SpaceX was not just dominant in 2023, it humiliated its competitors. We see this in launch services, in spacecraft operations (and, logically, manufacturing), and the tremendous mass its rockets lifted to orbit.

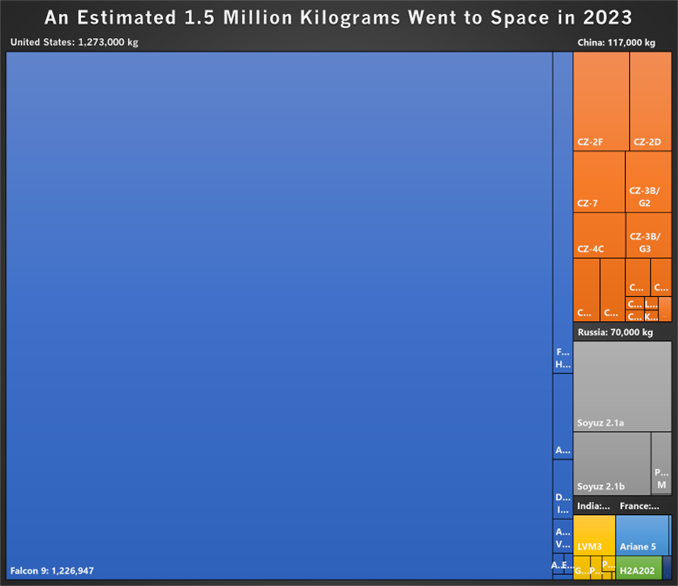

The first treemap highlights the successful orbital launches per orbital rocket system, the following shows spacecraft deployments, and the last shows the total mass lifted to orbit per launch vehicle—all during 2023. For those with some knowledge of SpaceX’s activities, the data is probably not surprising.

Don’t worry; there’ll be larger versions of the charts later. But their point is that the big block in each chart represents one company: SpaceX. Given its disproportionately high shares across the board in 2023, the space activities of all other companies, nations, and organizations were just background noise.

Successful Orbital Launches in 2023

Successful orbital launches in 2023 totaled 212—a record. The most radical changes impacting launches in 2023 had to do with SpaceX, ULA, and Arianespace. SpaceX radically increased its launches from the previous year while the other two companies significantly underperformed.

The first treemap (below) shows the most obvious and probably well-known fact: U.S. companies launched over half of the world’s successful orbital launches in 2023.

U.S. companies successfully launched 110 rockets in 2023 (versus 85 in 2022). SpaceX dominated with 96 launches. The company conducted 35 more successful launches in 2023 than in 2022 (61). In 2019, SpaceX launched 13 times including its first large batches of Starlink satellites. It increased its launches by 623% between 2019 and 2024.

However, the other U.S. launch services backslid in orbital launches conducted during 2023. Smallsat launcher Rocket Lab conducted eight launches in 2023 (down from nine in 2022), earning the company second place for U.S. launches.

United Launch Alliance (ULA) conducted three launches (less than half of its 2022 launches). Northrop Grumman was barely present with a single Antares launch for the year, half of the two launches it conducted in 2022. In contrast, a newcomer, Firefly Aerospace, launched two rockets in 2023, beating Northrop by one.

China’s launch services gave the nation second place for 2023’s overall global successful launches, garnering about 30% with 66 (up from 2022’s 62). The nation’s companies and organizations launched almost double the orbital rockets of the remaining countries with launch capability (Russia, India, France, Japan, South Korea, Iran, Israel, and North Korea) —combined.

While China’s launch services use a variety of rockets, the workhorse was the China Academy of Launch Vehicle Technology’s CZ-2D with 13 launches. In 2023, most of the smallsat-dedicated rocket types, six, were launched from China. Three launched from barges off China’s coast.

Russia’s launch services placed the nation third in successful orbital launches, with about 9% share of the world’s successful launches in 2023. The 19 launches were just two shy of the 21 conducted in 2022.

In 2023, nearly 90% (17) of Russia’s launches used the Soyuz 2 rocket. The remaining two used Proton. A third of the nation’s launches were for International Space Station (ISS) cargo or passenger transportation.

India’s launch services launched seven rockets in 2023, an increase from the four launched the year prior.

Launches using France’s Arianespace further slumped from 2022’s five launches to three in 2023. The company launched the last Ariane 5 in its inventory in 2023.

The rest of the nations with launch services—Japan, South Korea, Israel, Iran, and North Korea—conducted one to two launches that year.

SpaceX (and its Customers) in Orbit

The 2,850 total spacecraft deployed in 2023 was a record. The treemap below shows SpaceX’s share of 2023’s deployed spacecraft (nearly 70%). Over 99% of SpaceX’s 1,986 spacecraft deployed in 2023 were Starlink satellites.

SpaceX’s launch increase in 2023 is due to the company’s Starlink business. Of SpaceX’s 96 launches, two-thirds (63) deployed the company’s Starlink internet relay satellites. Put another way, 30% of the world’s launches and 70% of spacecraft were dedicated to one company’s space business, which catered to less than half a percent (2.3 million) of the world’s population (8 billion) in 2023.

SpaceX unsurprisingly leveraged its launch system for Starlink, but other companies have taken advantage of its low per-kilogram pricing, primarily through its Smallsat Rideshare Program. That’s where the smaller boxes representing other space operations companies and organizations in the spacecraft treemap become important.

There are a lot of space operators. At least 130—more than half of nearly 230--(other than Starlink) relied on the remaining 33 SpaceX launches to deploy their spacecraft in 2023.

In comparison, about 130 space operators total deployed satellites in 2019. During that year, SpaceX deployed satellites for 19 customers. The company also announced it would be offering its Smallsat Rideshare Program in 2019 and conducted its first launch under the program in 2021.

A sampling of companies and organizations demonstrates the diversity of SpaceX’s 130 launch customers. OneWeb (UK), IcEye (Finland), and GHGSAT (Canada) all deployed seven or more satellites using SpaceX in 2023.

Government organizations such as the United States Space Force (USSF), ESA, and the Norwegian Defence Research Establishment also launched satellites on SpaceX’s rockets in 2023. Other U.S. launch companies don’t have the customer diversity of SpaceX.

Of Rocket Lab’s successful eight launches in 2023, only one was for a non-U.S. customer—iQPS (a space radar company from Japan). iQPS was one of seven Rocket Lab customers. With only one government customer in 2023 (NASA), most of the company’s customers were commercial space operators such as HawkEye360 and Capella Space.

However, Rocket Lab’s customer diversity is less in 2023 than in 2019, a possible casualty of SpaceX’s Rideshare program. For example, companies that used Rocket Lab’s service in 2019, such as Fossa and Unseenlabs, appear to have hopped over to SpaceX by 2023.

The remaining U.S. launch services didn’t launch enough to demonstrate their customer diversity. ULA not only had fewer launches than SpaceX or Rocket Lab for 2023—three—but its customer diversity is…not there. All three launches were for U.S. customers, two for military and one for commercial missions. Firefly Aerospace nearly equaled ULA’s 2023 launches with two successful (kind of) launches. Northrop Grumman managed to launch once to the ISS during the same year.

The stark contrast to SpaceX’s customer diversity in its launch business is the launch services of China and their lack of it in 2023. While that nation’s launch services accounted for nearly 30% of the world’s launches in 2023, the 213 spacecraft those rockets deployed were over 7% of all spacecraft deployed. It’s nearly triple the 75 spacecraft deployed from China in 2019.

All but one of their 39 customers (up from 2019’s 29) were space operators from China. That one customer was the Egyptian Space Agency (three customers from other nations used China’s launch services in 2019). Those 39 made up 17% of launch customers across the globe despite the high number of launches from the nation’s launch services.

Strangely, then, even though China’s launch services conducted many launches in 2023, its launch market and customer focus are generally disconnected from the rest of the world. That disconnect implies that even though China’s space industry is increasingly interesting and even groundbreaking, as well as gaining investments, it all seems irrelevant in the global marketplace.

Part of China’s lack of customer diversity might be customer loss to SpaceX’s rideshare pricing and availability. But the lack might also be because no customer wants their service associated with launches in which rocket bodies drop on the heads of China’s residents. Not all launches from China do that, but that’s terrible potential publicity that no company wants to be associated with.

The launch customers deployed by the launch services from other nations are more diverse than in China. Russia’s launch services catered to 19 customers. Three of those customers came from three different countries, such as Belarus. Despite launching just three times, France's Arianespace had nine launch customers. About six were from nations/organizations other than France. Launch services from India catered to eight customers, half from other nations.

Mass: My God…It’s Full of SpaceX

The mass a rocket can lift to orbit is its upmass capability. The more upmass available, the more flexibility a rocket offers to customers. A rocket with great upmass capability, such as the CZ-5B or Ariane 5, can launch satellites or crew and cargo capsules. They can transport space station segments to orbit or lift slightly smaller but useful payloads beyond the Moon. The less upmass capability a rocket has, such as the dedicated smallsat launchers, the less flexibility they have.

The limitation of rockets with significant upmass capability is their expense. They are destroyed during launch, requiring customers using such a system to bear high launch costs. Those customers face similar challenges with the current staple of dedicated smallsat rockets. SpaceX’s reusable rockets changed that and have the mass receipts to prove it (as shown above).

Of the estimated 1.5 million kilograms of spacecraft mass the world’s space operators deployed in 2023, SpaceX launched about 87% of it (nearly 1.3 million kg). It’s almost double what the company’s rockets lifted in 2022 (~668,000 kg). The increase was due to its Starlink deployments, accounting for an estimated 1.07 million kg of mass in 2023. Even after subtracting Starlink deployments, the company’s Falcon rockets lifted an estimated 186,000 kg to orbit. That’s more than the ~104,000 kg SpaceX’s rockets lifted in 2019.

China’s launch services deployed ~117,000 kg to orbit in 2023, 69,000 kg shy of SpaceX’s total WITHOUT counting Starlink. The nation’s military had the largest estimated mass share in 2023 (over ~31,000 kg). While China’s mass total is respectable, it is down from the estimated 178,000 kg deployed in 2022. Also, the number of launches required to get it all into space, 66, highlights a propensity to rely on rockets with less upmass capability.

Despite the availability of large upmass capable rockets such as the CZ-5, China’s launch services used more rockets to lift less mass to orbit. SpaceX lifted slightly more with fewer launches—half, to be exact (33--before counting Starlink launches).

The majority (about 45,000 kg) of the estimated 70,000 kg that Russia’s launch services lifted to space in 2023 were primarily crew or cargo missions to the International Space Station (ISS). Oddly, the total is not far off from Russia's estimated launch mass in 2019—about 75,000 kg.

A few other launch services' mass totals are worth mentioning. ULA deployed slightly over an estimated 9,000 kg in 2023 (compared with ~44,000 in 2019). Arianespace’s rockets deployed an estimated 14,000 kg. Together (23,000 kg), the companies’ rockets lifted less than 2% of SpaceX’s total. India’s launch services deployed nearly 15,000 kg to space in 2023.

Even though SpaceX dominated the global space industry in 2023, it’s also driving changes in possibly more meaningful ways. Some changes, such as the increase in customers and customer diversity, are highly positive.

Based on the data, SpaceX is driving and benefiting from that change. It’s building a market out of new customers, primarily through its rideshare program. Some of those new customers, if they decide to continue operating in space, will likely keep using SpaceX to get to space. If that’s the case, the company’s competitors must play catch-up in yet another part of the space business.

Another change that might impact the industry in 2024 is SpaceX’s satellite manufacturing capability. The company has launched often, and manufactured satellites fast enough to keep up with its record 2023 launch cadence. In September 2023, for example, the company conducted nine Starlink launches, each carrying over 21 satellites. It’s building satellites quickly and in great numbers. Again, no other manufacturer exists that could compete should SpaceX earnestly enter the satellite manufacturing sector.

It was SpaceX’s world in 2023. 2024 looks to be more so. It’s worrisome that the space industry relies so much on SpaceX. That dependence won’t decrease in 2024. It will increase, despite the looming specter of ghost rockets that might launch “soon.” Even if they do, their impact on SpaceX’s business will be negligible.

John Holst is the Editor/Analyst of Ill-Defined Space, dedicated to analysis of activities, policies, and businesses in the space sector.

Contact Astralytical for your space industry analysis and insight needs.