Space Startups and Hype: Finding Facts in the Flash

As someone passionate about clear and effective communications, watching space companies move through their hype cycles is fascinating.

Some gain traction using a critical communications channel, typically a reporter, who then keeps the cycle turning, creating a snowball of special reports, interviews, and excited forecasts about the next best thing. When that happens, the cycle is successful since hype is promotion that relies on extravagant or exaggerated claims.

Exaggerated Importance?

Space startups are known for their hype cycles. They often embellish and inflate their importance to the planet (and investors). They are trying to gain attention by making themselves appear more significant than the toy dogs they are.

"New space" is a marketing term to hype space industry startups. That hype contrasts with a space industry dominated by slow-moving, entitled, legacy companies such as Boeing, ViaSat, and United Launch Alliance.

New space is meant to differentiate those legacy space companies from new companies such as Rocket Lab, OneWeb, and Planet. Adding the words "new space" + startup ratchets up a startup's hype. It sounds innovative, progressive, entrepreneurial, and hungry.

In 2021, over 500 investors invested in at least 212 space startups. Not all will be successful, and despite investors' confidence, not all space startups solve problems.

However, space startup investors like a return on investment. Some become a part of the hype problem to get that return, promoting their latest investment. Occasionally, they hype a space startup despite the severe challenges facing it. This scenario played out when an investor constantly pushed unrealistic Virgin Galactic visions in press releases and news articles.

Seeing Through the Hype

Space startups that use well-grounded hype exist. So how does one identify if a space startup's hype contains more substance versus one that is only a pile of hype? It might be tempting to follow the advice in the refrain, "Just don't believe the hype." However, there are some rules of thumb to avoid falling victim to predatory space startup "hypeness."

A simple method is to rely on the maxim, "If it is too good to be true, it probably is."

There are reasons why some people are bothered by a space startup's hype. Why will an asteroid mining venture be different this time if its plans are similar to those of defunct asteroid mining startups? Those questions and others originate from a person's experiences, providing some wisdom about life.

It is a reason why some entrepreneurs spin stories, as they attempt to replace investors' and customers' critical thinking with greed. Critical thinking diminishes the desired effects of a space startup's hype.

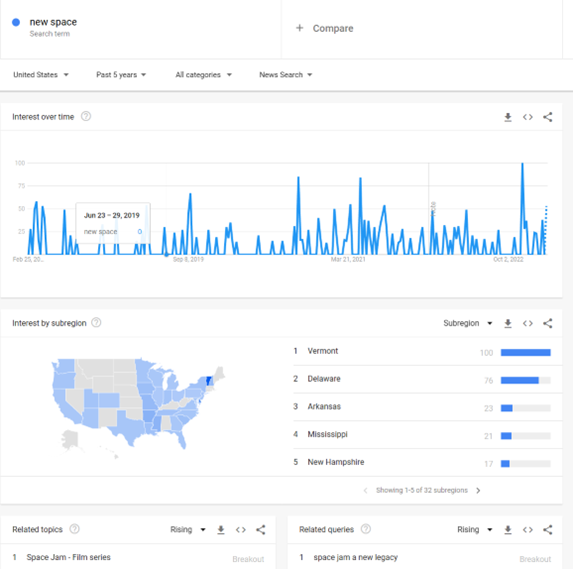

A way to see a startup's hype cycle can also be helpful. The tool at hand for determining a company's history of hype is Google Trends. Go to the site, type in a name, and Google Trends provides a decent result. Changing the date range and selecting "News Search" yields the charts below:

Typing in company names such as Relativity Space or Astra shows some cyclical hype attempts as their PR folks attempt to feed the news agencies the latest favorable company narrative.

The Hype Cycle

A tool that purportedly explores hype in-depth is the Gartner Hype Cycle, a methodology consisting of five stages: innovation trigger, peak of inflated expectations, trough of disillusionment, slope of enlightenment, and plateau of productivity. While those names sound like places in the "Princess Bride" or "Labyrinth," they should not be confused with them. The chart below displays the stages of increasing and diminishing hype over time.

The Gartner Hype Cycle (author's version)

The cycle is supposed to help people determine not just the amount of hype surrounding a technology but also make a better guess at where it is in the cycle. According to Gartner, the company uses the method to analyze 95 different cycles. However, Gartner also notes that it takes companies between three to five years for a technology to move through those stages (and then caveats that the speed could vary).

Gartner heavily promotes its tool, but the cycle's defined stages remain extremely useful in visualizing the hype surrounding space startups. As it is, space industry observers likely recognize the first two stages of Gartner's Hype Cycle from numerous space industry startup claims: the Innovation Trigger and The Peak of Inflated Expectations.

Stage 1

The "innovation trigger" describes when a new technology's concept or demonstration shows the potential to be useful (Is it solving a problem?).

However, there might not be an apparent commercial application. It may be that the technology isn't solving a problem. Still, the mere concept gets people excited enough to spread the word. Several space industry startups have hyped innovation triggers often.

Some offer only pretty renderings and appealing ideas. They introduce immature technologies and concepts, such as Moon bases and orbiting solar power stations. All have a common element—they are not real.

Is it possible for them to become a reality? Yes, but startups would require much more effort, investment, and time (typically more than startups have access to) to make them real. It is all a part of the hype cycle's first stage.

Alternatively, Stoke Space is a recent startup in the first stage of the hype cycle. The company is developing a concept, innovative rocket engine configurations, as an approach to creating a fully reusable launch system. The concept's promise, demonstration, and goal are appealing enough to excite people, but it is squarely in the innovation trigger stage.

Asteroid mining companies, such as Deep Space Industries and Planetary Resources, are startups that never moved beyond the innovation trigger stage of the cycle.

Stage 2

That next stage, the peak of inflated expectations, is when the startup's technology attracts attention and starts receiving investments for experimentation. Believe it or not, SpaceX's Falcon 9 may still fall under this stage.

The rocket is a proven platform that can launch spacecraft into orbit and beyond, but the Falcon 9's reusability attracts attention. It increases exceptional hype around the company as the still unusual characteristic of reusability draws increasing attention, investor interest, and more customers.

However, despite the company's reusability successes, few existing rocket companies seem to see (or at least publicly admit) how a reusable rocket makes sense for them.

Stage 3

The cycle's third stage, the trough of disillusionment, results from unmet inflated expectations and unforeseen challenges. Perhaps it turns out there are problems with the technology or concept. Alternatively, the space startup developing the concept may be losing money and discovering unanticipated challenges. Finally, it may be that the concept offers no solution for the target market—it is unneeded.

If any of those descriptions sound familiar, it may be because Virgin Galactic appears to be wallowing in the trough. It validated its innovation trigger, the suborbital spaceplane concept, and technology. Following that stage was the company’s buildup to a peak of inflated expectations.

According to Virgin Galactic, there was a market for quick suborbital rides—after all, a certain number of people put money down to get a ticket to ride. If more people ride to space, their example will excite others into doing the same.

Nevertheless, after the first passenger ride Virgin Galactic paused its operations, and the factors leading to the trough of disillusionment set in. Investors lost money. The company is facing supply chain problems and safety challenges for its spaceplanes. A year and a half after its only passenger launch, the general excitement and hype for Virgin Galactic's spaceplanes are fading. However, that does not mean the company is beyond redemption.

Reaction Engines, Ltd., is another older example of a startup in the disillusionment stage. It received a lot of press and funding for demonstrating a technology that might be able to provide space launch without the use of rocket engines. However, after over a decade, the company has yet to prove that its product can be commercially viable. While it might find its way out, Reaction Engines' hype cycle is taking much longer than other startups.

Stage 4

It may be that Virgin Galactic powers through to the hype cycle's fourth stage, the slope of enlightenment. A startup or several startups have identified the need for the technology or concept at this stage.

Perhaps a market can use it—just not the one initially identified. With the first generation left in the trough, a broader customer base might adopt newer, more reliable generations of technology.

The concept of low-Earth orbit (LEO) broadband satellites may be in that zone. It was never a question of whether it would be helpful. The question was whether it could make a profit, a valid concern considering the faltering decades-long history and the initial hype about how it would serve people in other nations without broadband access.

At least two companies are fielding these communications constellations, both working on newer generations of their satellites. One of those companies, SpaceX, appeared surprised that its satellites work for an application it never intended and disapproved of that use.

The surprise may be feigned, but using technology for an application other than the one the company intended is an age-old business conundrum. It is a circumstance that disapproving companies would do well to accept, move on, and learn. That attitude might help them reach the fifth stage: the plateau of productivity.

Stage 5 (and other notes)

The plateau is just what it says—the technology is practical enough to gain widespread adoption. People become increasingly productive using it. An example of a technology in this stage is the communications satellites in geosynchronous orbit (GEO), operated by companies such as SES or Intelsat.

For decades, consumers used those companies' technology and services. Governments and militaries contract for their services. However, this is the boring part of the hype cycle. What is exciting about technology that works as expected?

Although, Apple makes an art out of hyping boring technology. It generally lets others struggle through the first three stages and jumps in at the slope of enlightenment.

As a startup progresses through the hype cycle, it will likely not remain a startup as it reaches the cycle’s end. Also, the various technologies space startups work with require different cycle timelines, as each technology has different dependencies to account for before moving on to the next stage of hype.

For example, developing and building a communications satellite constellation might be more straightforward and take less time than building a fully reusable launch system. The former concept might complete the cycle in five years, while the other remains in the innovation trigger stage for nearly the same time. It all gets communicated on the chart like so:

Based on the author's guesses

Understanding any company's place in the hype cycle can help determine a product's authenticity. It explains why there is discomfort with a space startup's decision to change concepts, abandoning one somewhere in the hype cycle and starting from scratch with the next one. It means that investment allocated to the initial concept is ill-spent, as the startup's entrepreneur tries to explain why the change is necessary.

That type of hype was seen with Astra's concept, as it went from inexpensive smallsat launch to constellation operator to new smallsat launch and constellation. Each time Astra changed the story, the hype cycle restarted. It is not easy to become excited about a company that does not know what it offers.

The hype cycle can provide an understanding that a technology is at the peak of inflated expectations, ready to trip into the trough of disillusionment. Maybe it aids in realizing the technology is a dud. Alternatively, perhaps the trough is an opportunity to get in on the action before the technology moves up the slope of enlightenment.

As annoying as hype is, it is also helpful. Perhaps, however, not as startups intended. Press release frequency, wording, emotion, and carefully worded CEO statements point towards hype cycle stages. Applying hard-won knowledge, online tools, and an alternative view of space startup hype can provide a peek into the realities behind it.

John Holst is the Editor/Analyst of Ill-Defined Space, dedicated to analysis of activities, policies, and businesses in the space sector.

Contact Astralytical for your space industry analysis and insight needs.